Setting discount rates under IFRS 17: Getting the job done - Paper 3: Some practical considerations for reference portfolios

The principles-based approach under International Financial Reporting Standard 17 (IFRS 17) is both a blessing and a curse. In this paper, we cover the challenge of quantifying an illiquidity premium and discuss some practical considerations for reference portfolios. We look at asset markets to provide a measure, giving our observations on the use of a broad market benchmark portfolio, an illiquid market benchmark portfolio, and an actual asset portfolio. We then discuss the degree to which any illiquidity premium derived from a portfolio is subject to risk. A case study follows to highlight some of the considerations insurers should make when using different approaches when setting discount rates.

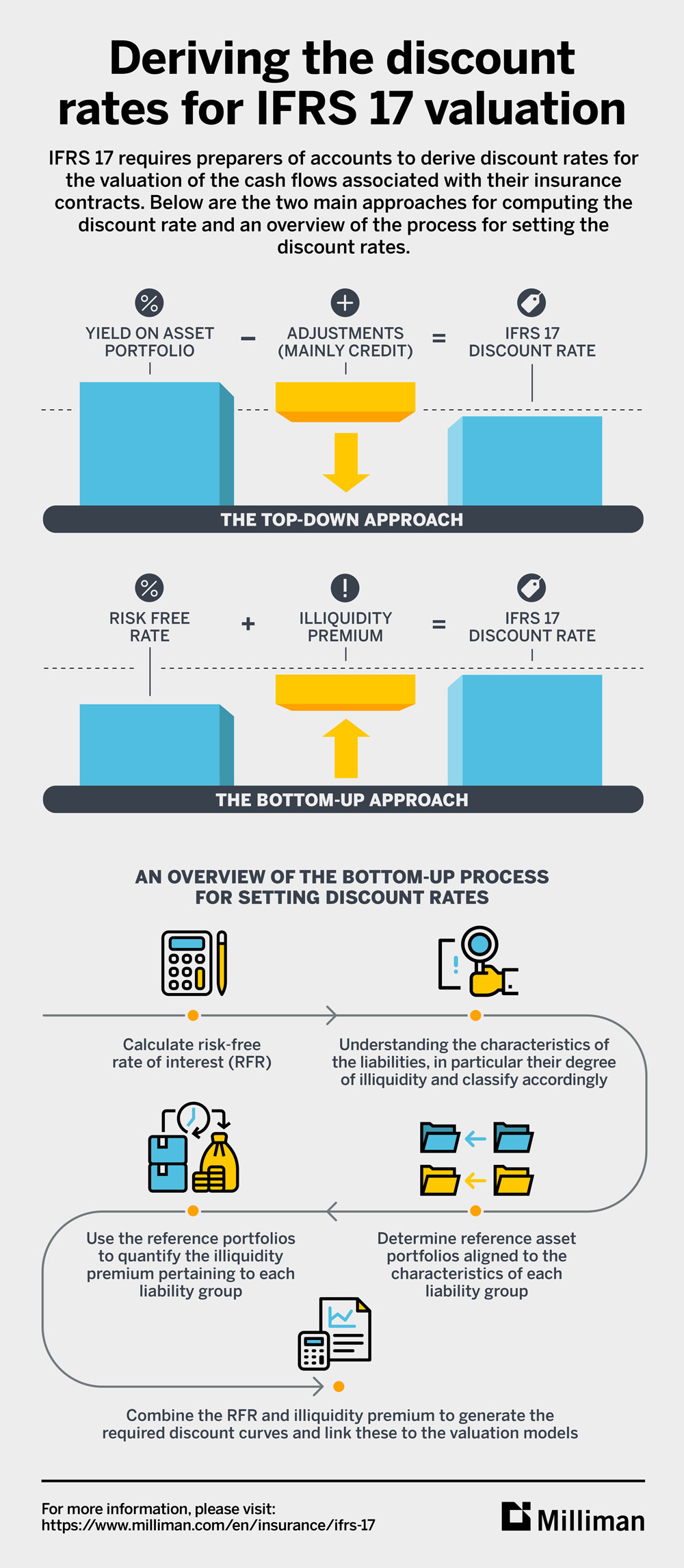

Below is an infographic that highlights the two main approaches for computing the discount rate and an overview of the process for setting the discount rates

Explore more tags from this article

About the Author(s)

Charles Boddele

Contact us

We’re here to help you break through complex challenges and achieve next-level success.

Contact us

We’re here to help you break through complex challenges and achieve next-level success.

Setting discount rates under IFRS 17: Getting the job done - Paper 3: Some practical considerations for reference portfolios

While setting the overall discount rate under IFRS 17 might seem overwhelming, we give some practical considerations to get the job done.